However there are certain exceptional situations wherein the amount can be withdrawn earlier. The decision of the withdrawal amount will also depend on the overall sum you might have in your provident fund account and the time you are away from retirement.

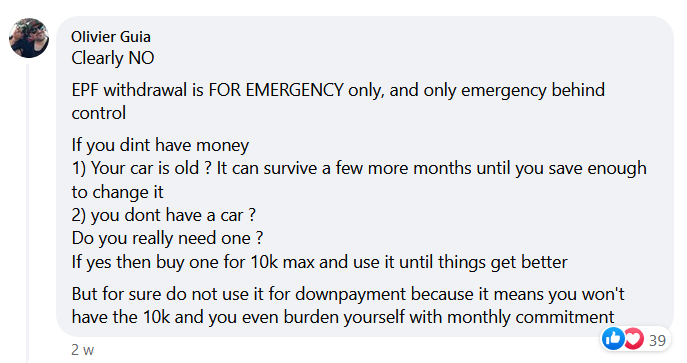

Would You Use Your Rm10 000 Epf Withdrawal To Buy A Car Topcarnews

EPF doesnt allow such withdrawal.

. So if you are 20-25 years away from retirement and have a decently large sum in your EPF account you can withdraw 20-30 of the same. But if you havent transferred that accout and if your EPF account is new and less than 7 years old then you cannot withdraw it. Visit Online Claims section When youve logged in you can look for Claim Form-31 19 10C 10D in the Online Services section.

Form 31 has to be submitted for withdrawal of EPF balance through your employer. Visit the unified EPF portal at httpsunifiedportal-memepfindiagovinmemberinterface and sign in. If I continue paying the EMI of Rs 50000 per month the loan will be cleared by March 2023.

However you can withdraw only once in your entire service tenure. The account holder can withdraw up to 75 per cent of the EPF balance or 3-months basic wages plus Dearness Allowance DA. Other than withdrawing to pay off their education loan like PTPTN and for their retirement EPF members can also withdraw their EPF savings to buy their first home and when they leave the country.

Employers Provident Fund Organization EPFO allows employees to partially withdraw money from their PF accounts and use it as a personal loan to deal with emergency situations. Select the reason for your withdrawal and on the next page upload relevant documents providing the reason. Login to the portal Visit the EPFO e-SEWA portal and login using your UAN and password and enter the captcha code.

On switching jobs an employee can apply for transfer of money from the EPF account through a form which is filled by the employee and attested by the designated authority at the employer. If you have flexi home loan you can withdraw it for house loan repayment then withdrawal it from your home loan accounts. Can we withdraw Rs 7 lakh each and close the loan.

The condition is that the employee must have contributed to PF for three years. Subscribers are allowed partial early withdrawal to meet short term needs where they can withdraw 75 per cent of the cumulative EPF corpus after leaving the job within one month and if they stayed unemployed for more than two months then they can withdraw 100 per cent of the. The new norms of EPFO are applicable for the salaried person and the employees having the EPF account.

The condition for this is the investor must have contributed to PF at least for five years. From the top menu bar click on the Online Services and select Claim Form-31 19 10C from the drop-down menu. Jul 29 2013 0500 PM.

EPF Withdrawal For Covid Treatment. Balance can be withdrawn after remaining unemployed for 2 months. The EPF loan eligibility varies depending on the reason for which the EPF corpus is being withdrawn.

An EPFO member is eligible for Covid advance from ones EPF account even after leaving his or her job provided full. Now withdrawal of EPF has become very simple and fast through an online portal. The following information would help you get a better idea of the various conditions under which you can withdraw your EPF.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. Both my wife and I are working and have around Rs 20 lakh each in EPF. I am in the.

At the age of 54 years. Go to the Claims section in the online services tab. How to withdraw PF online with UAN.

90 of the total corpus amount. Yes you can withdraw your EPF if you wish to. Home Loan For the repayment of a home loan also an employee can withdraw PF partially.

Under the withdrawal system there are two types of loans one can get one is refundable and non refundable refundable is where one needs to repay the loan amount on periodic basis and that non refundable people are not required to pay anything and that amount is the pf withdrawal amount from the EPF account. No car house loan However u can withdraw EPF if your are 50 yo This post has been edited by ceo684. This is sometimes known as EPF loan or EPF personal loan.

You can withdraw your EPF only if you have transfered your EPF account from your previous employer. Once during entire service tenure. Also that account needs to have been open for 7 years including the 4 years spent in this company.

This is however an inaccurate description as unlike other loans this amount does not have to be repaid. Apart from all these reasons you can also withdraw 90 of your EPF balance from Employee Provident Fund account after reaching 54 years of age. While this is often referred to as an EPF Loan it is not exactly a loan but actually an advance as the amount withdrawn does not have to be paid back non-refundable in most cases unlike in case of a.

But now account holder will have to wait till attaining the age of 57 years to withdraw 90 of the accumulated balance. Member Details will be displayed on the screen. Verify the details and proceed to the online claim.

Withdrawal from EPF after leaving an Organization. Following are the eligibility criteria for EPF withdrawal. You can withdraw 90 of EPF balance once you reach the age of 57 years Earlier a withdrawal was allowed up to 90 of the EPF balance one year prior to retirement ie.

In this condition 90 withdrawal is possible. Steps to Withdrawal EPF Online Due to Corona. How to withdraw your EPF balance.

Else the easiest way is using EPP by credit card. Visit the official website of EPF and sign in with your UAN and password. However Shahril cautioned that members should try their best to keep their savings in the EPF to benefit from the principle of compounding returns.

The norms to withdraw Employees Provident Fund EPF have been relaxed further to enable members of the EPFO to withdraw money from their EPF accounts to fund the purchase or construction of house. They can withdraw money from the PF account against the covid treatment. And you can subsequently use the money to pay off credit card dues.

Moreover the EPFO employees have got the additional facilities ie apart from a medical emergency they can take PF loan for the.

Would You Use Your Rm10 000 Epf Withdrawal To Buy A Car Topcarnews

Would You Use Your Rm10 000 Epf Withdrawal To Buy A Car Topcarnews

Would You Use Your Rm10 000 Epf Withdrawal To Buy A Car Topcarnews

0 Comments